Public Limited Company Registration Process Simplified for Entrepreneurs

Introduction

For entrepreneurs in India aiming to scale big, raise capital from the public, and build corporate credibility, registering as a Public Limited Company (PLC) is a powerful option. A public limited company offers a distinct legal identity, limited liability to its shareholders, and access to funding through public issue of shares.

This guide simplifies the public limited company registration process, explains its benefits, and outlines all key steps for entrepreneurs planning to launch a public company in India.

What is a Public Limited Company?

A Public Limited Company is a type of company formed under the Companies Act, 2013 that offers its shares to the public. It can be listed on a stock exchange or remain unlisted but still have the freedom to raise capital from a large number of investors.

Key Features:

- Minimum 3 directors and 7 shareholders

- No maximum limit on the number of shareholders

- Shares can be freely transferred

- Required to comply with SEBI and Companies Act regulations

- Higher transparency and disclosure norms

Why Choose a Public Limited Company?

Entrepreneurs may choose a public limited company structure for the following reasons:

1. Capital Generation

Public companies can raise funds by issuing shares, debentures, and other instruments to the general public.

2. Enhanced Credibility

Regulatory compliance, audits, and public disclosures boost investor confidence and market reputation.

3. Business Expansion

Public companies can secure large capital, scale operations, and even list on stock exchanges (NSE, BSE).

4. Limited Liability

Shareholders’ personal assets are not at risk; liability is limited to their investment in the company.

5. Transferability of Shares

Shares can be easily transferred without affecting the company’s operations or structure.

Read More: One Person Company Registration Services in India

Eligibility Criteria to Register a Public Limited Company in India

- Minimum 3 directors (at least one must be a resident of India)

- Minimum 7 shareholders

- DIN (Director Identification Number) and DSC (Digital Signature Certificate) for all directors

- A registered office address in India

- Capital contribution as prescribed (no minimum paid-up capital requirement post 2015 amendment, but practically ₹5 lakh is advisable)

Step-by-Step Process to Register a Public Limited Company

Step 1: Obtain Digital Signature Certificate (DSC)

Each director must obtain a DSC to digitally sign the e-forms submitted to the Ministry of Corporate Affairs (MCA).

Time: 1–2 working days

Cost: ₹1,000–₹2,000 per DSC

Step 2: Get Director Identification Number (DIN)

DIN is allotted to individuals who intend to be company directors. It can be applied via the SPICe+ form during registration.

Step 3: Name Reservation Using SPICe+ Part A

Propose a unique company name and check availability through the MCA RUN (Reserve Unique Name) service or SPICe+ Part A.

Tips:

- Name should not infringe on existing trademarks

- It should not be identical or similar to any existing company

- Use proper prefixes/suffixes (e.g., “Limited”)

Read More: LLP Registration in India

Step 4: Draft MOA and AOA

Prepare the Memorandum of Association (MOA) and Articles of Association (AOA):

- MOA defines the company’s objectives and scope

- AOA contains internal rules and regulations

These are submitted electronically with the incorporation form.

Step 5: File the SPICe+ Form (Part B)

This integrated form enables:

- DIN allotment

- Name reservation

- PAN and TAN application

- EPFO & ESIC registration

- GST registration (optional)

- Professional Tax (in applicable states)

- Bank account opening

Attach documents like:

- Identity & address proof of directors/shareholders

- Registered office proof (rent agreement, utility bill, NOC)

- MOA and AOA

- Declaration from directors (DIR-2)

- Consent to act as director (INC-9)

Time: 5–7 working days

Step 6: Certificate of Incorporation

Upon approval, the Registrar of Companies (RoC) issues the Certificate of Incorporation, which includes the CIN (Corporate Identity Number) along with PAN and TAN.

Post-Incorporation Compliances

After registration, the company must comply with the following:

- Open a current bank account

- Appoint the first auditor within 30 days

- Issue share certificates to shareholders

- File commencement of business within 180 days (INC-20A)

- Maintain statutory registers and records

- Hold Board and Shareholder Meetings

- Annual filings: MGT-7 (Annual Return), AOC-4 (Financial Statements)

- Tax registrations and returns: TDS, GST (if applicable)

Read More: Company Registration Services in India

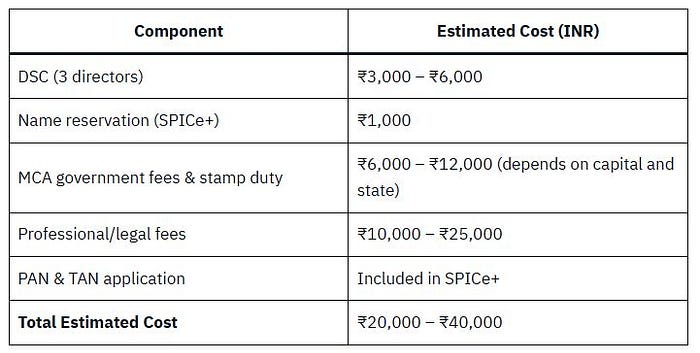

Estimated Cost of Public Limited Company Registration in India

Benefits of Public Limited Company for Entrepreneurs

- Easy access to capital markets

- Scalability and growth potential

- Enhanced brand reputation

- Option to list on stock exchanges

- Attracts institutional and international investors

- Clear ownership structure and shareholding transparency

Disadvantages to Consider

- Complex compliance requirements

- Public disclosures can impact confidentiality

- Risk of takeover through hostile share acquisition

- Costly and time-consuming registration and management

Conclusion

Registering a Public Limited Company in India is ideal for startups and entrepreneurs with big growth ambitions. While it involves detailed documentation and strict compliance, the benefits — such as capital access, credibility, and legal protection — make it a rewarding structure for the long term.

Whether you’re launching a tech startup, expanding a family business, or entering the public investment space, this company model can help take your entrepreneurial journey to the next level.

FAQs: Public Limited Company Registration in India

Q1. What is the minimum number of directors and shareholders required for a public company?

A minimum of 3 directors and 7 shareholders is mandatory for forming a public limited company in India.

Q2. Can a public limited company be registered online?

Yes. The complete registration process is handled online through the MCA portal using the SPICe+ integrated form.

Q3. Is there a minimum capital requirement to start a public limited company?

There is no statutory minimum paid-up capital, but practically, at least ₹5 lakh is advisable to cover regulatory requirements and initial expenses.

Q4. Can a public company issue IPOs immediately after registration?

No. A newly registered public company must fulfill eligibility criteria, appoint underwriters, and file with SEBI before launching an Initial Public Offering (IPO).

Q5. What is the difference between a private and public limited company?

- Private Ltd: Cannot issue shares to the public, max 200 members

- Public Ltd: Can issue shares publicly, no upper limit on shareholders

Q6. How long does it take to register a public limited company?

It generally takes 10 to 15 working days, depending on document correctness and RoC processing speed.

Q7. Can NRIs or foreign nationals be directors/shareholders in a public limited company?

Yes, but at least one director must be a resident Indian, and FEMA regulations must be followed for foreign investments.

Q8. What is the SPICe+ form used for?

SPICe+ is a multi-purpose form used for company incorporation, PAN, TAN, DIN, GST, and other registrations.

Q9. Is it mandatory to appoint a Company Secretary (CS)?

Yes, for public companies with a paid-up capital of ₹10 crore or more, appointing a full-time Company Secretary is mandatory.

%20Definition,%20Benefits,%20and%20How%20It%20Works.jpg)

Comments

Post a Comment